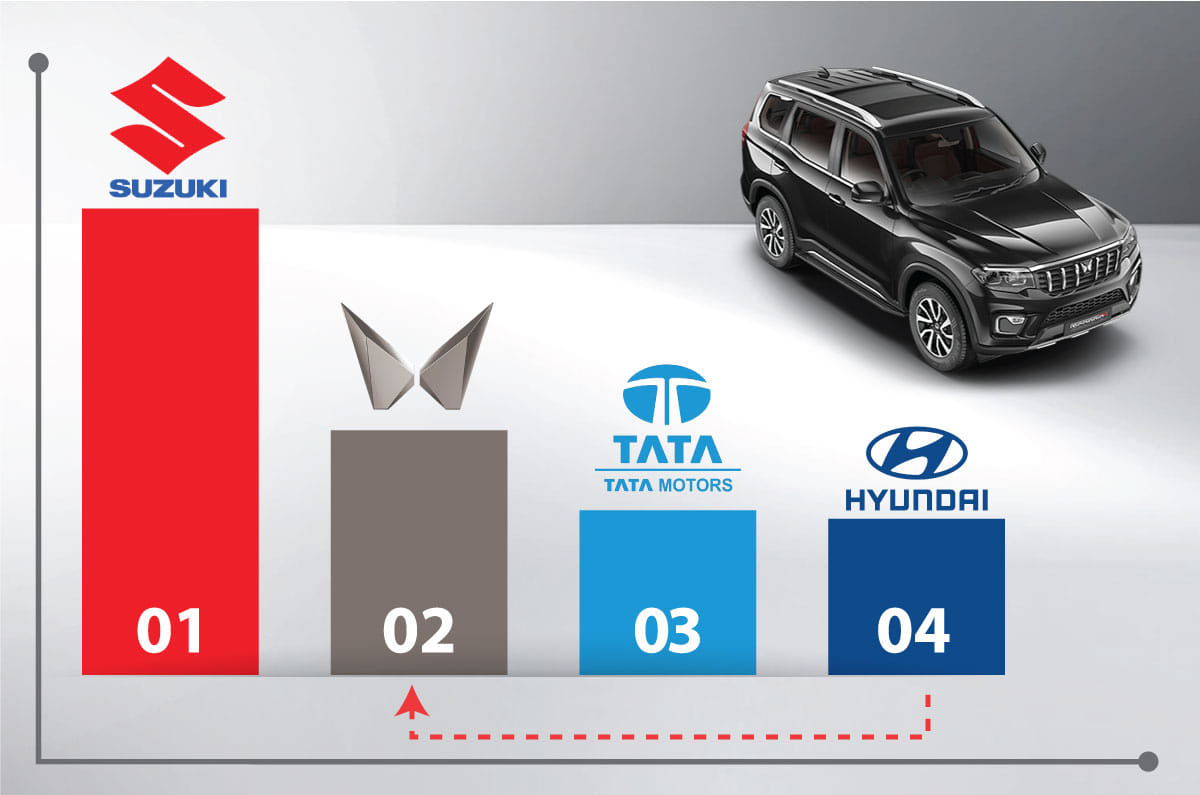

Mahindra & Mahindra has moved up to the No. 2 position in India’s passenger vehicle market for CY2025, based on Vahan data till December 25. This is the first time the brand has finished ahead of both Hyundai and Tata Motors in annual numbers, with Maruti Suzuki continuing as the market leader, registering 17.50 lakh units.

Mahindra’s registrations stand at around 5.81 lakh units in 2025, compared to 4.90 lakh units in 2024. This jump has moved the brand from No. 4 last year to No. 2 in 2025 YTD, making it the biggest gainer among all 16 carmakers. Its January-November 2025 sales of 5,74,657 units reflect an 18 percent year-on-year increase for the period.

Tata Motors is set to finish No. 3 with 5.52 lakh units, narrowly ahead of Hyundai (5.50 lakh units) in CY2025. This marks the first time in years that Hyundai has slipped from its long-held second position to fourth.

- Strong SUV demand across regions secured steady volumes throughout 2025

- Thar growth and consistent Scorpio and Bolero sales lifted overall rankings

- New EV additions expanded the portfolio and helped cement second place

SUV demand drives consistent monthly volumes

Strong traction across core SUV portfolio

| Model | Jan-Nov 2025 | % share |

| Scorpio | 1,61,103 | 28.03 |

| Thar | 1,07,326 | 18.67 |

| Bolero | 93,436 | 16.25 |

| 3XO | 90,608 | 15.76 |

| XUV700 | 80,251 | 13.96 |

| BE 6, XEV 9e | 38,841 | 6.75 |

| XUV400 | 2,764 | 0.48 |

| Marazzo | 328 | 0.05 |

| TOTAL | 5,74,657 | 100 |

Mahindra’s rise is tied to strong demand for its body-on-frame and monocoque SUVs. Models like the Scorpio, Bolero, Thar and the XUV range have kept volumes consistent throughout the year. The brand’s SUV-only portfolio aligns with the market shift toward utility vehicles, which now make up the majority of PV sales.

Long-running models, such as the Bolero and Scorpio continue to post high demand outside metros, supporting consistent monthly numbers. The Bolero and Bolero Neo together contributed 93,436 units (16 percent share), driven mainly by demand in semi-urban and rural markets.

The 3XO compact SUV recorded 90,608 units, growing 12 percent YoY, and now accounts for nearly 16 percent share. The XUV700 posted 80,251 units, reflecting a small YoY decline of 4 percent but still holding a 14 percent share in Mahindra’s portfolio.

Thar becomes No. 2 model after Scorpio

Brand shift led by strong demand for new Thar Roxx

Mahindra’s biggest model shift this year is the rise of the Thar brand. Combined sales of the three-door Thar and five-door Thar Roxx reached 1,07,326 units, up 55 percent YoY, giving the pair a 19 percent model-wise share. This moves the Thar family to the No. 2 spot, up from No. 4 in CY2024. The Thar Roxx is estimated to contribute around 65 percent of these volumes.

The Scorpio N and Scorpio Classic remain Mahindra’s top sellers, with 1,61,103 units, a 4 percent YoY increase and a 28 percent share.

Electric SUVs add incremental growth

New BEVs contribute 7 percent of total volume

Mahindra’s new EVs – the BE 6, XEV 9e, and the recently launched XEV9s – together contributed 38,841 units, giving the electric line-up a 7 percent share of CY2025 wholesales. The addition of these born-electric models has expanded Mahindra’s presence in the EV segment and added to its overall yearly volumes.