A series of strategic government interventions and significant industry milestones defined India’s automotive narrative in 2025. Policy moves – ranging from fuel mandates to tax restructuring – reshaped vehicle pricing and manufacturer strategies, while the market itself celebrated the enduring legacies of its most popular nameplates. This recap focuses on the pivotal changes, events and records that mattered most to everyday buyers.

Budget opens select doors

The Union Budget presented on February 1 included a reduction in import duty on motorcycles with an engine capacity below 1,600cc from 100 percent to 50 percent for completely built units, semi-knocked down units and completely knocked down units.

Additionally, the budget exempted customs duties on lithium-ion battery cells, cathode materials and battery management systems, as well as on waste and scrap of battery parts and critical minerals. The government also fully exempted basic customs duty on 35 additional capital goods used in EV battery manufacturing to strengthen domestic production.

Relaxation of import rules for vintage cars

The government relaxed import rules for vintage cars in February, allowing licence-free imports of vehicles 50 years or older instead of just pre-1950 models. They won’t come cheap, though, with duties, Goods and Services Tax (GST) and registration totalling about 250 percent, plus shipping and insurance.

Strict rules govern sales and transfers, but overall, it was great news. The 50-year limit is on a rolling basis. The exact date to determine the vehicle’s age will be from the date of its first registration after the initial sale.

April brings fuel mandates

From April 1, E20 fuel (petrol with 20 percent ethanol content) replaced E10 nationwide, as the government aims to reduce petroleum imports while supporting the agricultural sector through ethanol demand. But this has compromised fuel efficiency – while ARAI projected a 1-6 percent reduction, carmakers claimed a 7-8 percent drop. A real-world test by Autocar India revealed that actual efficiency losses were higher than official estimates.

The controlled tests showed varied results from model to model, as we tested vehicles produced between 2024 and 2025, which have all been recalibrated to run on E20 fuel. For older BS4 vehicles, we tested vehicles produced in 2016, which showed a similar drop in fuel efficiency.

Moreover, concerns still persist among vehicle owners about E20 compatibility and the effect of the fuel in the long term, with limited public education about which vehicles can safely use the fuel.

Renault takes full control of the Chennai plant

Renault took full ownership of the Indian manufacturing joint venture after Nissan sold its 51 percent stake in April. Relinquishing control of the plant meant Nissan lost direct influence over capacity, operational decisions and workforce management. All manufacturing-related decisions, including the allocation of production between Renault and Nissan models, are now made by Renault. The French brand also inaugurated a state-of-the-art design centre in Chennai. Built with an investment of Rs 14.68 crore, it is Renault’s second-largest global design studio after Paris.

India-UK FTA

July marked the signing of the Free Trade Agreement (FTA) between India and the UK, with significant implications for the automotive sector. Import duties on luxury and large-engine-capacity cars and bikes will reduce from 110 percent to just 10 percent over five years through a quota system that’ll gradually increase volumes. Premium brands, including Aston Martin, Bentley, McLaren, JLR and Rolls-Royce, which are manufactured in the UK, will benefit from the significant price reductions across their respective portfolios.

Meanwhile, the UK will eliminate import duties on Indian EVs from year six, opening a new export channel for Indian manufacturers. Maruti Suzuki is already exporting the made-in-India e-Vitara to the UK, and it plans to export the Victoris as well, while Tata and Mahindra could also capitalise on these export avenues.

Popular nameplates’ big anniversaries

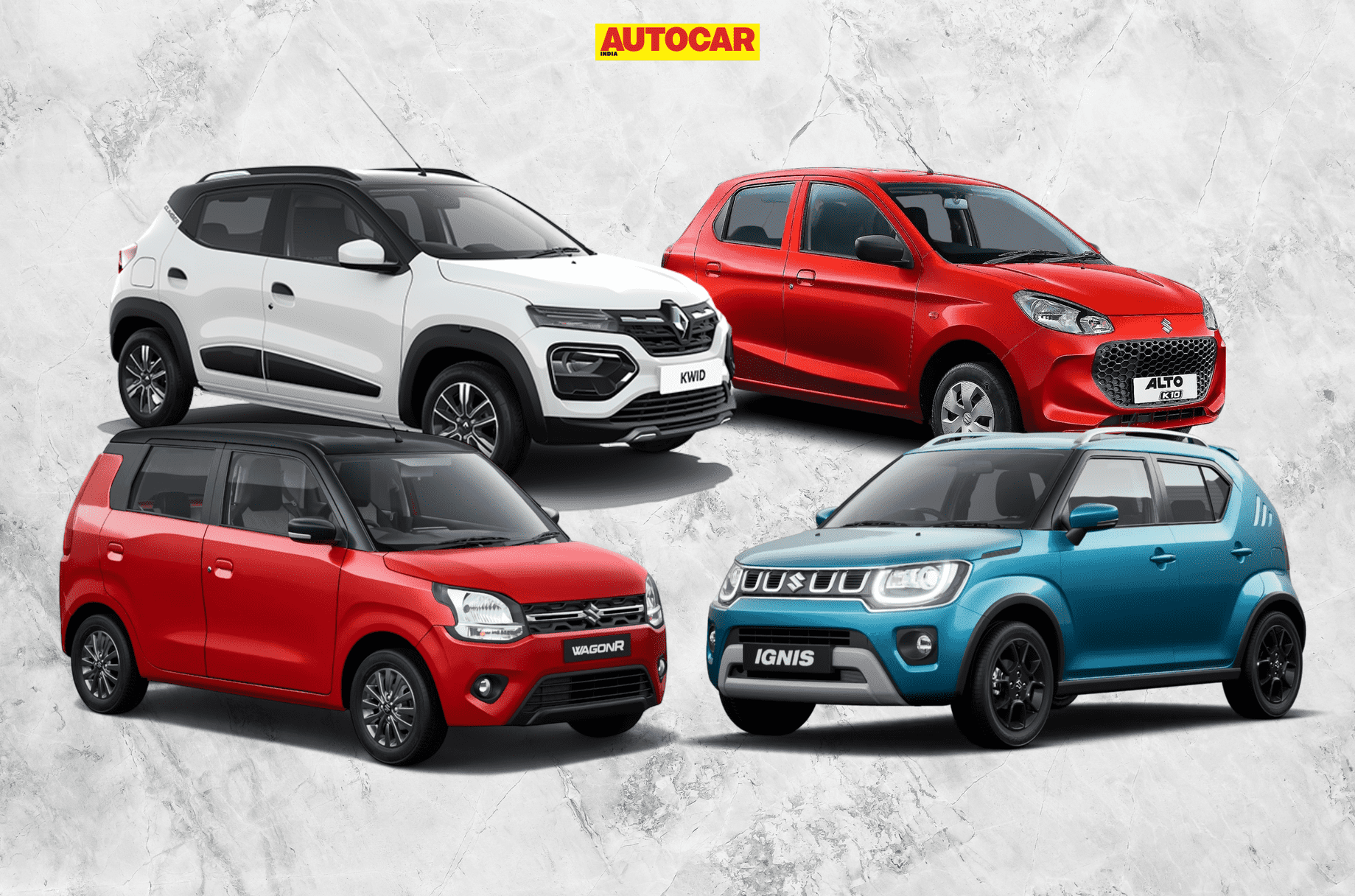

Several popular nameplates celebrated major anniversaries this year, underlining their sustained relevance in a changing market. The Hyundai Creta, which cemented the midsize SUV segment, completed 10 years, spanning two successful generations. The Toyota Innova witnessed its 20th anniversary, continuing its dominance in the MPV segment with a reputation for comfort and reliability.

The Maruti Swift, a hatchback that famously brought sporty appeal to the mass market, also celebrated 20 years. Meanwhile, the Maruti Alto, which once defined the entry level of the affordable segment, completed 25 years and crossed the 5 million sales mark. The Mahindra Bolero also saw its silver jubilee, standing tall as a rugged workhorse that has served generations of owners.

Entry of established global EV players

July witnessed Tesla’s much-anticipated arrival with the Model Y, with its first showroom in Mumbai and 16 Supercharger stations across India. Tesla’s Supercharger network with 250kWh charging rates represents the kind of seamless charging infrastructure Indian EV manufacturers need to emulate.

Moreover, Vietnamese automaker Vinfast entered India in November, launching the VF 6 and VF 7 electric SUVs in the cut-throat midsize and premium midsize SUV segments of India. The company also announced its plans for producing electric buses and two-wheelers alongside passenger vehicles.

GST 2.0 reforms

On September 22, the implementation of GST reforms revised levies across vehicle categories. GST rate on compact cars up to 4 metres in length, with petrol engines up to 1,200cc and diesel engines up to 1,500cc, dropped from 28 percent to 18 percent. For vehicles over 4 metres, the reforms eliminated the cess-based system, replacing it with a flat 40 percent GST rate, resulting in effective reductions of 5-10 percentage points, depending on engine capacity and body style.

For two-wheelers up to 350cc, the GST rate has been reduced from 28 percent to 18 percent. However, motorcycles above 350cc now attract a 40 percent tax as compared to 31 percent earlier, which places them in the same category as sin goods. Following the rollout of new GST rates, manufacturers strategically cut prices beyond the tax benefit to stimulate demand.

Stricter emission targets reshape portfolios

The government’s draft Corporate Average Fuel Efficiency III (CAFE 3) norms introduced fuel efficiency and CO2 emission targets for passenger vehicle manufacturers. This will reshape how automakers plan their future product mix to meet the sales-weighted average CO2 emissions targets across a manufacturer’s entire fleet. Carmakers must gradually reduce average fleet consumption from 3.73 litres per 100km from April 2027 to 3.01 litres by 2032.

The revised proposal could give a breather to the cost-sensitive small car segment, under 4 metres, with engines up to 1,200 cc and weighing up to 909 kg, which can claim an additional 3 g CO2/km reduction in their declared performance. The tighter norms are expected to boost electrification and hybrid adoption as manufacturers use EVs and strong hybrids as “super credits” to lower fleet-wide averages.

Government renews EV manufacturing push

The government’s SPMEPCI (Scheme to Promote Manufacturing of Electric Passenger Cars in India) scheme was launched in June to attract global EV players to invest in India. The program requires a minimum investment of Rs 4,150 crore and offers reduced import duty of 15 percent on CBUs valued over Rs 30 lakhs. The four-month application window was closed in October without a single OEM applying. The government then relaunched SPMEPCI in October, with a new application portal unveiled, offering global EV manufacturers a second opportunity to invest.

In a parallel move to strengthen the EV supply chain, the government approved a Rs 7,280 crore program in December to incentivise rare earth permanent magnets manufacturing. This is followed by India’s supply chain vulnerabilities for rare earth elements (critical for EV motors), which were unveiled early in the year, and slowed India’s electrification plans.

World’s highest motorable road

In October, India set a new global benchmark in high-altitude infrastructure. The Mig La pass, situated at 19,400ft, became the world’s highest motorable road, surpassing the previous record held by Umling La. Constructed by the Border Roads Organisation, this engineering marvel connects Hanle to Fukche near the Line of Actual Control and improves all-season access to remote border regions.

Battle intensifies in midsize SUV segment

The midsize SUV segment experienced heightened competition as numerous brands introduced new launches or significant updates targeting the core volume of this market.

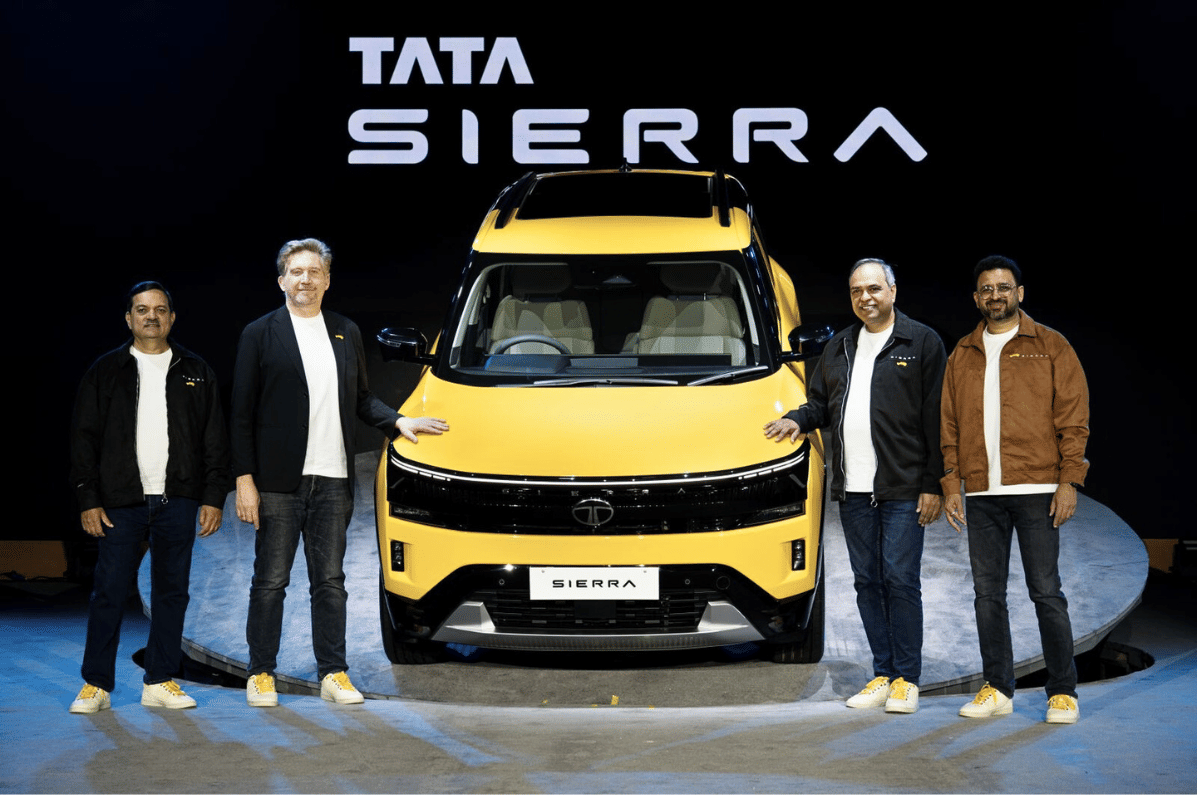

Challenging the segment leader, the Hyundai Creta, Maruti Suzuki launched the Victoris in September, and Tata Motors revived the iconic Sierra nameplate in November. In December, Kia unveiled the refreshed Seltos, scheduled to launch on January 2, 2026. Moreover, Renault confirmed the return of the Duster with India-specific design changes, debuting on January 26, 2026. This reinforces just how strategically important this single segment has become this year.

Penalties galore for old vehicle owners

In a sudden move, the Delhi government banned fuel sales to petrol vehicles over 15 years old and diesel vehicles over 10 years old in July. Over 350 fuel stations across Delhi-NCR were fitted with AI-powered cameras to detect “end-of-life” vehicles and have them impounded. Widespread backlash and technical issues forced the rule to be rolled back, but later in December, the government banned the entry of non-BS VI vehicles into the capital and enforced a new “no PUC, no fuel” rule in an effort to improve the AQI.

Owning older vehicles also became more expensive, with fitness test fees rising sharply. While the base fee for a 15-year-old vehicle remains largely unchanged, charges increase significantly thereafter, climbing to Rs 2,000 for two-wheelers and Rs 15,000 for LMVs over 20 years old.

Market defies early projections

Industry associations began 2025 forecasting just 1-2 percent growth as the market sputtered through the first quarter. The first nine months saw cumulative volumes declining year-on-year. Then the GST restructuring in September catalysed a dramatic reversal. Manufacturers strategically leveraged the tax cuts, and the combination of festive timing lured more footfall in the showrooms. September through November recorded strong growth, pulling the market from negative territory to projected calendar year 2025 growth of 4.5-5 percent. January to November sales exceeded 4.2 million units, and the year is likely to close at 5 million units. Manufacturers now project 2026 growth at 5-7 percent, sustained by the momentum built in the year’s final quarter.

The year demonstrated how the manufacturers respond to the policies and government mandates, and consumers made decisions shaped by both.